Foreign direct investment (FDI) flows to structurally weak, vulnerable and small economies fell in 2017, according to UNCTAD’s World Investment Report 2018.

The decline was especially steep in economies that are dependent on commodity-related investment, and FDI flows to least developed countries (LDCs1 ) was down 17% to a four-year low.

“The four-year low point of FDI in LDCs is a serious concern in light of the investment needed for sustainable development,” UNCTAD Director, Division on Investment and Enterprise, James Zhan said.

Flows to least developed countries (LDCs) declined by 17%, to $26 billion, while flows to landlocked developing countries (LLDCs) rose by 3%, to $23 billion. In small island developing States (SIDS), FDI increased by 4%, to $4.1 billion.

With a 23% contraction in the global FDI inflows, the share of LDCs remained below 2% of the global FDI. A modest gain in LLDCs and SIDS did not translate into significant improvement in their shares of global FDI: just 1.6% and 0.3%, respectively.

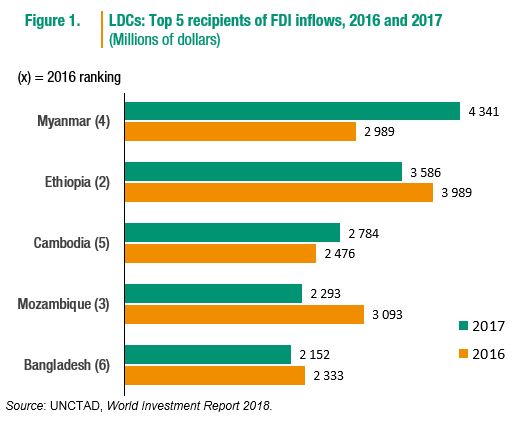

Although Asian LDCs registered robust FDI growth and two thirds of African LDCs attracted more FDI flows than the previous year, the contractions posted by Angola and Mozambique were severe. Myanmar was the largest FDI recipient among LDCs in 2017. The five largest FDI recipients attracted almost 60% of the group’s total.

Looking to the future, FDI to LDCs could see a recovery, boosted by an expected increase of FDI in Africa. However, the value of greenfield FDI projects announced in 2017 – a key indicator of future investment activity – fell to a 10-year low. Foreign investors, mostly from Asian developing economies, scaled down their capital spending plans, especially in the services sector, targeting Bangladesh, Cambodia and Myanmar. This weakens FDI prospects for the Asian LDCs.

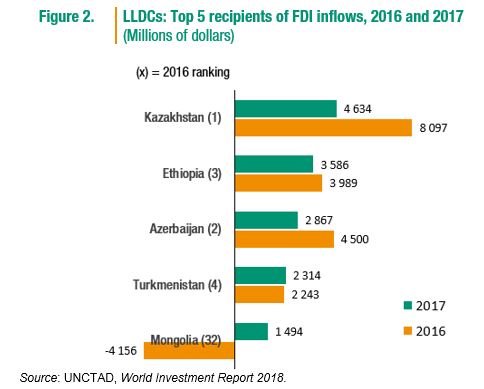

After five consecutive years of decline (2011–2016), FDI flows to the 32 LLDCs2 rose marginally. This modest increase restored total flows to LLDCs – the majority of which (17) are also LDCs – to the level of 2008, at the start of the crisis. All LLDC subgroups by region, except for those in transition economies, registered gains. Kazakhstan remained the largest FDI recipient in this group. FDI inflows in the top five LLDCs represented two-thirds of aggregate flows to all LLDCs.

In 2018, FDI to LLDCs could recover further, but uncertainty and fragility remain. The value of announced greenfield projects declined in 2017. FDI flows to most of the LLDC economies remain vulnerable to adverse external factors, and their investment potential is tied to developments in neighbouring countries through which exports and imports transit.

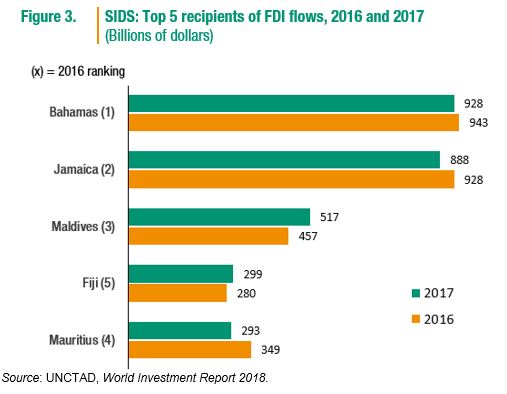

FDI flows to the 29 SIDS3 rose for a second year to $4.1 billion, led by 9% growth in the 10 Caribbean SIDS. FDI inflows to the five African SIDS and the 13 SIDS in Asia and Oceania shrank. More than 70% of the group’s total FDI flows were registered in the top five SIDS, led by the Bahamas.

Prospects for SIDS remain fragile, with only a few expecting FDI growth in the near term. The stagnating volumes of greenfield FDI projects announced in 2016–2017 underscore a persisting challenge for SIDS to attract and sustain foreign investment. Services will continue to dominate, but FDI flows to the sector are slowing down.