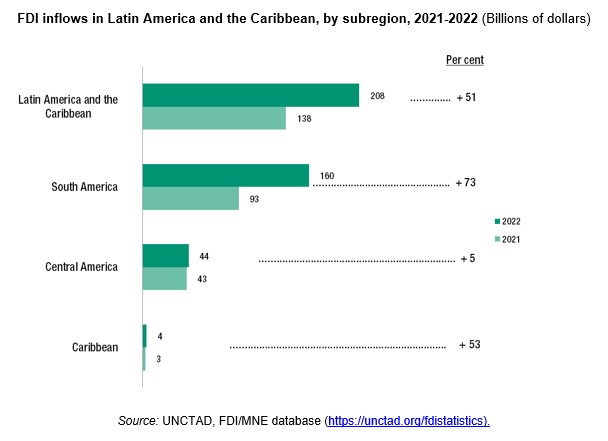

UNCTAD’s World Investment Report 2023 published on 5 July shows that foreign direct investment (FDI) flows to Latin America and the Caribbean rose by 51% to $208 billion in 2022, sustained by higher demand for commodities and critical minerals.

In South America, flows to Brazil rose by 70% to $86 billion – the second-highest level ever recorded – due to a doubling of reinvested earnings.

The number of international project finance deals rose by 29% to 138, ranking the country fifth worldwide. FDI more than doubled to $15 billion in Argentina, doubled in Peru to $12 billion and rose by 82% in Colombia, to $17 billion.

Flows to Mexico, the second-largest recipient in Latin America, increased by 12% to $35 billion, with a rise in new equity investment and reinvested earnings. The value of net cross-border mergers and acquisitions (M&As) jumped to $8.2 billion (from less than $1 billion in 2021).

In the Caribbean (excluding financial centres), FDI increased by 53% to $3.9 billion, mainly driven by growth in inflows to the Dominican Republic, to $4 billion.

Regional economic groupings attract flows

Over the past five years, regional economic groupings attracted FDI flows in line with the overall trend in Latin America and the Caribbean.

Flows rose to member States in the Asociación Latinoamericana de Integración (up 34%, to $195 billion), the Mercado Común del Sur (up 35%, to $105 billion) and to member States in the Caribbean Community (doubled, to $6.5 billion).

FDI fell by 11% to member States of the Sistema de la Integración Centroamericana to $13 billion.

In 2022, the share of intraregional greenfield project announcements remained relatively small, at 11% of all projects in the region (8% in terms of value), but still higher than in 2017, when it was 8% of the total (6% in value).

Latin American and Caribbean multinational enterprises (MNEs) had 62% of the value of their greenfield projects in the region.

Cross-border M&A activity increased by 80% to $15 billion. The manufacturing sector recorded the highest increase in net sales, particularly in food, beverages and tobacco, chemicals, paper and paper products.

However, the services sector remained the largest sector, with net sales worth $9.6 billion, mainly in information and communication.

The value of announced greenfield investment increased by 57%, with most commitments going to the extractive and automotive industries.

The number of announced international project finance deals fell by 18%, with declines mostly in mining, transport infrastructure, oil and gas.

The United States, Spain and the Netherlands remained the largest investors in the region in 2021.

-----------------------------------------------

About UNCTAD

The United Nations Conference on Trade and Development (UNCTAD) promotes inclusive and sustainable development through trade, investment, finance, and technology.

UNCTAD's World Investment Report is a leading publication that provides analysis and insights into global investment trends and policies.

World Investment Forum

The key findings of the World Investment Report 2023 will inform discussions at UNCTAD’s 8th World Investment Forum to be held in Abu Dhabi from 16 to 20 October 2023 under the theme "Investing in sustainable development".

The forum will bring together government leaders, global CEOs, policymakers and other stakeholders to find solutions and reach consensus on priority issues. Its outcomes will feed into negotiations at the annual climate summit COP28, which will also be held in the United Arab Emirates.

-----------------------------------------------