International production, an engine of global economic growth and development, has been seriously affected by the pandemic, according to UNCTAD’s World Investment Report 2021.

Global investment was hit much harder than other macroeconomic variables, with a decline by one third over 2019 levels, and major shocks to greenfield investment in industrial and infrastructure projects – the most productive kind.

Early indicators on greenfield investment and international project finance – and the experience from past foreign direct investment (FDI) downturns – suggest that even if firms and financiers are now gearing up for “catch-up” capital expenditures, they will still be cautious with new overseas investments in productive assets and infrastructure. Nevertheless, global FDI may have already bottomed out and reversed course.

“Both policymakers and firms are now focused on building back better. Resilience and sustainability will shape the investment priorities of governments and firms,” said UNCTAD Acting Secretary General Isabelle Durant.

For firms, the push for supply chain resilience could lead to pressures in some industries to reconfigure international production networks through reshoring, regionalization or diversification. For governments, recovery stimulus and investment plans focusing on infrastructure and the energy transition imply significant project finance outlays.

“The implications for international investment flows of both sets of priorities are significant,” Ms. Durant said.

Push for supply chain resilience

This year’s report describes three set options for multinational enterprises (MNEs) to improve supply chain resilience. They include (i) network restructuring, which involves production location decisions and, consequently, investment and divestment decisions; (ii) supply chain management solutions (planning and forecasting, buffers, and flexibility); and (iii) sustainability measures. Due to the cost of network restructuring, MNEs will first exhaust other supply chain risk management options.

However, the impact of the resilience push on international investment in the short-term will be limited. “In the absence of policy measures that either force or incentivize the relocation of productive assets, MNEs are unlikely to embark on broad-based restructuring of their international production networks,” said UNCTAD’s director of investment and enterprise, James Zhan.

He added that resilience is not expected to lead to a rush to reshore but to a gradual process of diversification and regionalization as it becomes part of MNE location decisions on new investment.

According to the report, in some industries the process may be more abrupt. Policy pressures and concrete measures to push towards production relocation are already materializing in strategic and sensitive sectors. Recovery investment plans could provide further impetus: most investment packages, in both developed and developing countries, include domestic or regional industrial development objectives.

Recovery investment priorities

Recovery investment plans in most countries focus on infrastructure sectors – including physical, digital and green infrastructure.

These are sound investment priorities because: (i) they are aligned with the investment needs of Sustainable Development Goals (SDGs); (ii) they are sectors in which public investment plays a bigger role, making it easier for governments to act; and (iii) they have a high economic multiplier effect, important for demand-side stimulus.

A broader perspective on priorities for promoting investment in sustainable recovery should include not only infrastructure but also industries that are key to growth in productive capacity.

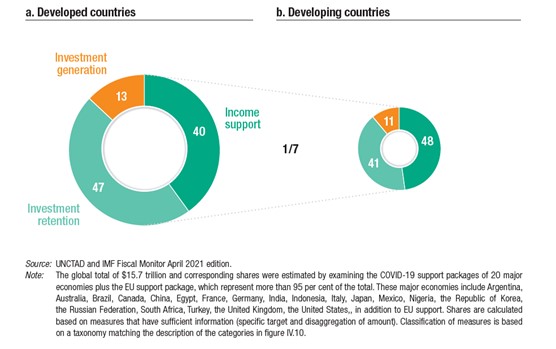

However, the bulk of recovery finance has been set aside by and for developed economies and a few large emerging markets. Developing countries account for only about 10% of total recovery spending plans to date (Figure 1).

The magnitude of the plans is such that there are likely to be spillover effects – positive and negative – to most economies. In this context, international project finance, one of the principal mechanisms through which public funds will aim to generate additional private financing, will channel the effects of domestic public spending packages to international investment flows.

Recovery investment packages are likely to affect global investment patterns in the coming years owing to their sheer size. The cumulative value of recovery funds intended for long-term investment worldwide is already approaching $3.5 trillion, and sizeable initiatives are still in the pipeline.

Considering the potential to use these funds to draw in additional private funds, the total “investment firepower” of recovery plans could exceed $10 trillion – which is close to one third of the total SDG investment gap as estimated at the time of their adoption.

These numbers clearly indicate the strain on the delivery capacity of both public institutions and firms will be enormous, with the annual investment push amounting to, at a minimum, triple the growth achieved in the peak year of the last decade.

The use of international project finance as an instrument for the deployment of recovery funds can help maximize the investment potential of public efforts, but also raises new challenges.

Addressing such challenges and maximizing the impact of investment packages on sustainable and inclusive recovery will require concerted efforts and increased support by bilateral and multilateral lenders, and guarantee agencies – to counter risks and upward pressure on project financing costs in lower-income developing countries.

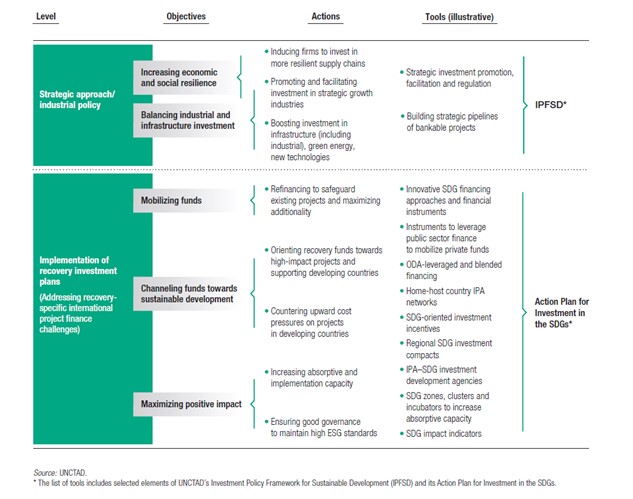

A policy framework for investment in sustainable recovery

Promoting investment in resilience, balancing stimulus between infrastructure and industry, and addressing the implementation challenges of recovery plans requires a coherent policy approach.

At the strategic level, industrial policy will shape the extent to which firms in different industries will be induced to rebalance international production networks for greater supply chain resilience (from a firm perspective) and greater economic and social resilience (from a country perspective). It will also drive the promotion and facilitation of investment in industry, needed for complementarity with infrastructure spending.

For developing countries, industrial development strategies are also the basis for building a viable pipeline of bankable projects. The lack of shovel-ready projects in many countries remains a key barrier to attracting more international project finance.

The risk now is that, in the absence of projects that have gone through the phases of design, feasibility assessment and regulatory preparation, the roll-out of recovery investment funds will incur long delays.

At the level of execution, addressing recovery investment challenges can draw on initiatives comprised in UNCTAD’s Action Plan for Investment in the SDGs, which includes actions aimed at funds mobilization, channeling and impact management (Figure 2).

“UNCTAD believes that the drive on the part of all governments worldwide to build back better, and the substantial recovery programmes that are being adopted by many, can boost investment in sustainable growth. The goal should be to ensure that recovery is sustainable, and that its benefits extend to all countries and all people,” Ms. Durant said.

Figure 1 – Stimulus programs, rescue and recovery

(Per cent)

Figure 2 – Investing in sustainable recovery: A policy framework