Below are highlights and figures on Africa from UNCTAD’s Review of Maritime Transport 2020 released today and the organization’s other analyses.

Impact of COVID-19

- COVID-19 has negatively impacted Africa. In the second quarter of 2020, UNCTAD estimated the drop in Africa’s exports at -35% and the drop in imports at -25%. By July 2020, there were some improvements, but numbers still pointed to double-digit drops of -17% for imports and -21% exports.

- By late June 2020, the drop in the number of ship calls in Sub-Saharan Africa stood at -9.7% while the drop in container ship calls stood at -12.7%. The impact on bulk shipping was less pronounced. Port calls by dry bulk carriers declined by 7.7% while calls by wet bulk carriers was less affected, falling by 1.4 % only.

- African ports have shown mixed trends in terms of impact on connectivity. In three African ports (Lagos, Durban, TangerMed), for example, connectivity levels were found to have coped well with the pandemic compared with other ports in the region, despite blank sailings negatively impacting service frequency.

- Restrictions affecting inland transportation have created some challenges to cross-border crossings. For example, in some African countries, the time taken to pick up cargo after customs release increased in 2020 compared to the same period in 2019. Trucks took longer times to return to their departure points due to the restrictions imposed to contain the pandemic. Such disruptions led also to delays in the return of empty containers to the ports (e.g. port Mombasa), which often led to retention charges set by shipping lines.

- Like in other regions, digitalization is recognized as key to navigating the COVID-19 crisis, hence capacity-building in this area is required. However, a “readiness gap” in the maritime sector’s automation and technology levels puts African countries at a disadvantage. Maritime transport in Africa needs to address challenges facing innovation and technology, infrastructure quality, regulation and governance, human capital and skills, as well as business and investment.

- Addressing sustainability concerns is an important agenda item at the global level and Africa’s maritime sector should improve its ability to align activities with sustainability goals and principles as well as build the resilience of its infrastructure, services and operations.

- Achieving the 2050 greenhouse gases’ emissions targets set out by the International Maritime Organization (IMO) is critical, and countries, including in Africa, have an important role to play in enforcing IMO rules as a way of minimizing climate change impacts on the sector.

Demand (merchandise trade, maritime cargo): key trends in seaborne trade and port cargo traffic

- While about one-third of African countries are landlocked, maritime transport remains the main gateway to the global marketplace. Africa’s international trade relies heavily on shipping and ports.

- Africa accounts for a small share of world merchandise trade by value: about 2.5% of exports and 3% of imports in 2020.

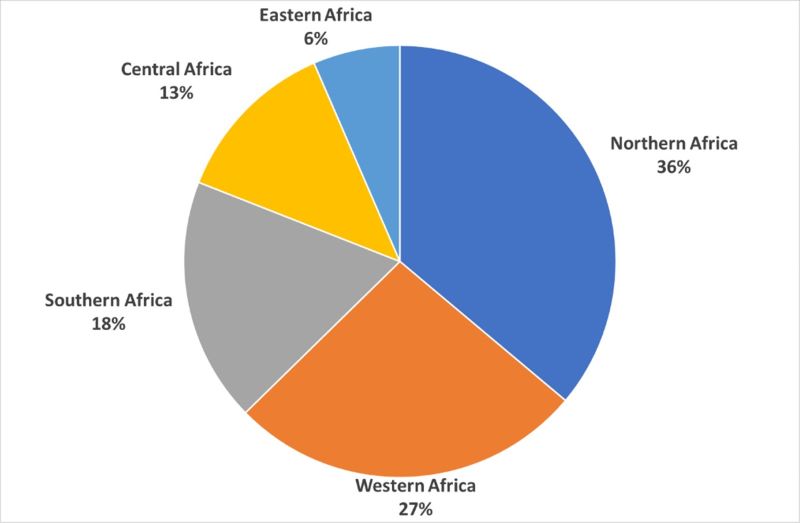

- In terms of volumes, however, and based on maritime trade data estimated by UNCTAD, Africa contributes relatively larger shares to globalized maritime trade. In 2019, African ports loaded close to 7% of world maritime trade (exported) and unloaded 4.6% of this trade (imported). These contributing shares, however, remain below those of developing Asian and American regions. Sub-regional participation in Africa’s maritime trade in 2019 is shown in figure 1 below.

Figure 1 - Sub-regional participation in Africa’s maritime trade, 2019

Source: UNCTAD, https://unctadstat.unctad.org/datacentre/dataviewer/US.SeaborneTrade

- The marginal relative contribution of Africa to maritime trade is also observed when looking at its share of developing countries’ maritime trade. In 2019, Africa accounted for about 12% of the volumes loaded in developing countries and 7% of the unloaded ones. The dominant shares were held by developing Asia, followed by developing Americas (Latin America and the Caribbean).

- The contribution of Africa to maritime trade flows is marginal unlike Asia, which has benefited from its greater integration into global manufacturing and trading networks, promoting intraregional trade.

- Maritime trade in Africa continues to be shaped by the continent’s trade concentration and limited diversification. Accordingly, about half of the goods exported by sea in 2019 composed of tanker trade, while over two-thirds of imports consisted of dry cargoes (dry bulks and containerized goods).

- Africa’s container ports accounted for a modest share of about 4% of global containerized trade volume, much of which comprised imports of manufactured goods.

- Targeted trade and industrial policy measures and regional integration initiatives such as the African Continental Free Trade Agreement (AfCFTA) have the potential to enhance Africa’s containerized trade flows.

Shipping fleet developments, connectivity and port performance

- Participation in the supply of shipping services remains an ambition in Africa, as the continent’s ownership of the world fleet is limited, with only Nigeria to be featured among the top 35 owning nations, with a share of 0.31% in deadweight tonnage as of 1 January 2020.

- Only Liberia makes the list of top flag states, ranking second globally after Panama in terms of deadweight capacity and third after Panama and Marshall Islands in terms of the value of the fleet. As of 1 January 2020, Liberia had increased the ship-carrying capacity registered under its flag by 13% and accounted for 13% of the total world deadweight.

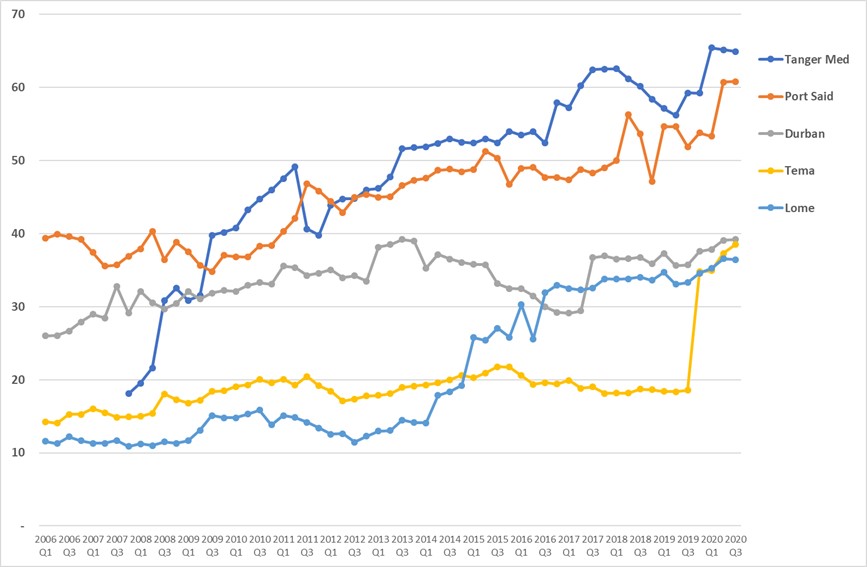

- African countries’ shipping connectivity is strongly influenced by their geography. The best-connected countries are those at the continent’s corners, where international shipping routes connect to hub ports, notably in Morocco, Egypt and South Africa. They are followed by sub-regional load centres, notably Djibouti, Togo and Mauritius. The top five African ports on UNCTAD’s liner shipping connectivity index (LSCI) during from the first quarter of 2006 to the third quarter of 2020 are presented in figure 2 below.

Figure 2 - Top 5 African ports, first quarter 2006 to third quarter 2020

Source: UNCTAD calculations, based on data provided by MDS Transmodal

LSCI of all ports: https://unctadstat.unctad.org/datacentre/dataviewer/US.PLSCI

- Like in other regions, ports in Africa tend to be generally more connected to each other. These intraregional connections do not necessarily carry trade between neighbouring ports, but the high connectivity is the result of being connected to the same overseas routes, in combination with feedering and transshipment services. For example, Durban and Cape Town in South Africa are connected to each other by services provided by 12 companies. In Angola, Luanda is most connected to Cape Town, South Africa with seven companies, while Mombasa, Kenya is most connected to Dar es Salaam, Tanzania through direct services by 10 companies. By comparison, there are only six companies that connect Mombasa, Kenya with Ningbo, China. The connectivity level of Tanger Med, Morocco is highest with Algeciras and Valencia in Spain, through services provided by nine liner companies.

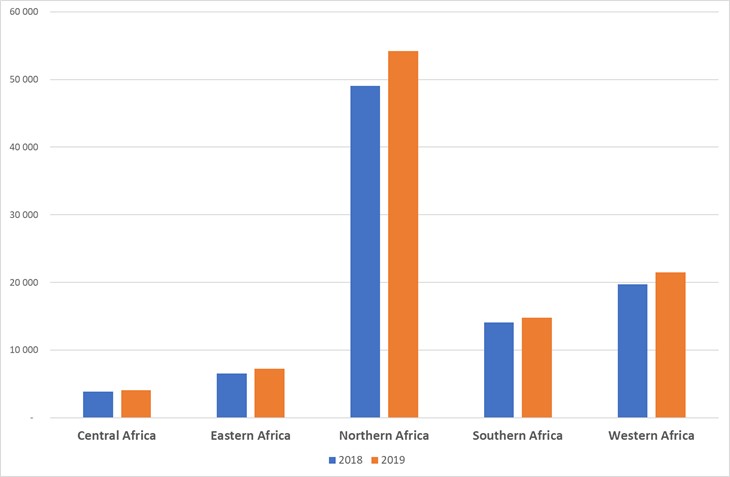

- Five of the bottom 10 countries ranked according to their port performance (as measured by average port hours weighted by the size of vessels) are located in Africa. The continent requires improved infrastructure and implementation of requisite port and trade facilitation reforms that can help ports in the region to handle the ever-growing demand effectively. Port calls (arrivals) in African sub-regions, for 2018 and 2019 are presented in figure 3 below.

Figure 3 - Port calls (arrivals) in African sub-regions, 2018 and 2019

Source: UNCTAD, based on data provided by MarineTraffic

All countries’ data is available on UNCTADstat: https://unctadstat.unctad.org/datacentre/dataviewer/US.PortCallsArrivals

More details by country and vessel type are available in the maritime country profiles: https://unctadstat.unctad.org/CountryProfile/MaritimeProfile/en-GB/710/index.html