Foreign direct investment (FDI) flows to developed economies fell by 37% to $712 billion in 2017, according to UNCTAD's World Investment Report 2018.

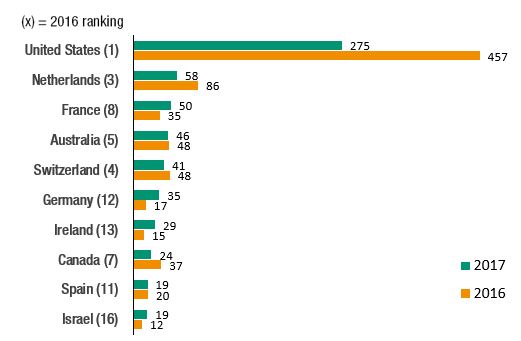

The report reveals that growth in FDI during 2015–2016, when annual inflows to developed economies exceeded $1 trillion, ended abruptly in 2017. Large reductions in FDI flows to the United Kingdom, following an exceptionally high value of mergers and acquisitions (M&As) in 2016, and to the United States of America, where authorities clamped down on tax inversions, were the major factors behind the decline.

“In developed economies, although the short-term outlook appears positive, trade tensions significantly affect FDI prospects for 2018,” UNCTAD Director of the Division on Investment and Enterprise James Zhan said.

FDI inflows to France and Germany bounced back in 2017, but overall flows to European countries declined due to a normalization of FDI to the United Kingdom. In North America, inflows shrank due to diminishing intra-company loans and divestments. Inflows held steady in developed economies in the Asia-Pacific region, in contrast to the global trend.

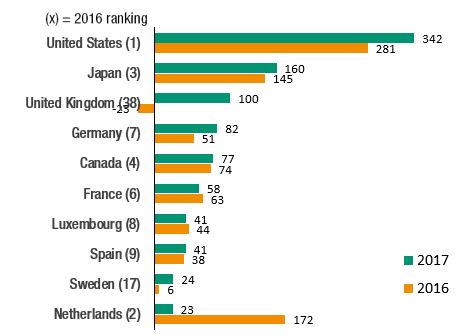

In Europe, combined outflows fell by 21% to $418 billion. Outflows from Germany and the United Kingdom rose sharply. Those from France maintained their high level. FDI outflows from the Netherlands – the largest source country in Europe in 2016 – declined by $149 billion to just $23 billion, mainly due to declining M&A purchases.

Outflows from North America rose by 18%. When the prospect of tax reform became more certain towards the end of 2017, United States multinational enterprises (MNEs) postponed the repatriation of overseas earnings, adding to reinvestment. In the Asia-Pacific region, outflows from Japan continued to expand, to $160 billion.

FDI to developed economies is projected to increase moderately in 2018. The rise in the value of announced greenfield projects (up 25% to $318 billion) is a positive sign. However, tensions in global trade policymaking continue to create uncertainty. The repatriation of accumulated profits by United States MNEs as a result of the tax reform is likely to reduce FDI outflows from the United States – with mirror effects elsewhere.

Figure 1. Developed economies: Top 10 recipients of FDI flows, 2016 and 2017

(Billions of dollars)

Source: UNCTAD, World Investment Report 2018.

Figure 2. Developed economies: Top 10 investors of FDI flows, 2016 and 2017

(Billions of dollars)

Source: UNCTAD, World Investment Report 2018.

Press Release

For use of information media - Not an official record

UNCTAD/PRESS/PR/2018/019 WIR-Foreign direct investment to developed economies declined, mostly due to fewer mega deals and reduced intra-firm financial flows, says United Nations report

Geneva, Switzerland, 6 June 2018