Foreign direct investment (FDI) flows into Latin America and the Caribbean (excluding offshore financial centres) increased by 6 per cent to $182 billion in 2013, UNCTAD’s World Investment Report 20141 reveals – the combined result of a 64 per cent increase to Central America and the Caribbean to $49 billion, and an 6 per cent decline to South America to $133 billion. The total FDI figure for the Latin America and the Caribbean region, including offshore financial centres, was $292 billion in 2013, according to the report.

The report looks forward to the Sustainable Development Goals (SDGs) and is subtitled Investing in the SDGs: An Action Plan.

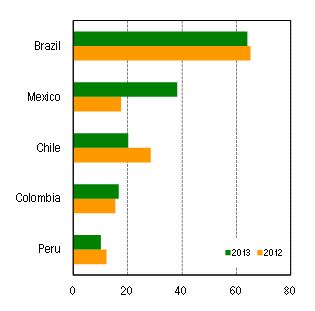

In previous years FDI growth was driven largely by South America but in 2013 flows to this subregion declined after three consecutive years of strong growth. Among the main recipient countries in South America, Brazil saw an overall slight decline by 2 per cent. However flows increased significantly in the primary sector, and to industries such as motor vehicles, electronics and beverages, although they decreased as a whole in manufacturing and services, accounting for the overall dip in FDI.

Flows into Chile and Argentina declined by 29 per cent and 25 per cent to $20 billion and $9 billion respectively, due to FDI decrease into the mining sector. Inflows to Peru also decreased, by 17 per cent to $10 billion, owing to much lower reinvested earnings as a result of declining prices of the country’s main mining exports such as copper and gold.

In contrast, FDI flows into Colombia increased by 8 per cent to $17 billion, largely on the back of cross-border M&A activity in the electricity and banking industries. A strong FDI increase was registered in the Bolivarian Republic of Venezuela (up by 119 per cent to $7 billion).

Flows into Central America and the Caribbean (excluding offshore financial centres) increased by 64 per cent to $49 billion, largely due to the $18 billion acquisition of the remaining shares in Grupo Modelo by Belgian brewer Anheuser-Busch InBev − which more than doubled inflows to Mexico to $38 billion. Other increases were registered in Costa Rica (up by 14 per cent), Guatemala and Nicaragua (up by 5 per cent).

FDI outflows from Latin America and the Caribbean (excluding offshore financial centres) declined by 31 per cent to $33 billion, mainly because of stalled acquisitions abroad and a surge in loan repayments to parent companies by foreign affiliates of Brazilian and Chilean transnational corporations (TNCs).

Looking ahead, new opportunities for foreign investors in the oil and gas industry, including shale gas in Argentina and energy reform in Mexico, signal positive prospects for FDI in the region. In manufacturing, transnational carmarkers are also pushing investment plans in Brazil and Mexico. In Brazil for example, in addition to new investment from Chery (China) and Hyundai (Republic of Korea), Volkswagen, Toyota, Renault and PSA Peugeot Citroën are planning significant increases in their production capacity. In Mexico, Japanese and German manufacturers, including Chrysler, Nissan, Mazda and Honda, are driving a production surge.

The potential growth of the automotive industry appears promising in both Brazil and Mexico, with differences between the two in terms of government policies and TNC strategies. This is reflected in their respective levels and forms of participation in global value chains. In Mexico most of automotive production is exported with higher imported value added. Brazil's producers, often foreign TNCs, serve mostly the local market. Although the country's exports are lower, they contain a higher share of value added produced domestically.

Figure 1. Top 5 recipients of FDI flows in Latin America and the Caribbean, 2012 and 2013

(billions of US dollars)

Source: UNCTAD. World Investment Report 2014.

Note: Countries are ranked on the basis of magnitude of 2013 FDI flows.

Offshore financial centres are not included.

Figure 2. Top 5 investors from Latin America and the Caribbean, 2012 and 2013

(billions of US dollars)

Source: UNCTAD. World Investment Report 2014.

Note: Countries are ranked on the basis of magnitude of 2013 FDI flows.

Offshore financial centres are not included.

Full report: http://unctad.org/en/PublicationsLibrary/wir2014_en.pdf