UNCTAD is finalizing its 7th major version of its DMFAS software which is designed to respond to the evolving needs of the countries to manage their public debt.

Debt management offices face significant pressure to manage more complex debt instruments, meet transparency requirements, handle data quality issues and improve operational risk management. Moreover, software industry advances make it necessary to update the DMFAS technological framework.

With DMFAS 7, debt offices will benefit from a new version of the DMFAS software that will satisfy user requirements for improvements of the system’s functions both in the technical and functional areas, in line with international standards and best practices.

DMFAS 7 includes all DMFAS 6 functionalities and:

- Expanded data coverage, including monitoring of contingent liabilities and of Public Private Partnerships (PPPs)

- Redesigned Debt Securities module

- Improved data quality

- Improved reporting

- Expanded analysis

- Facilitated IFMIS integration

- Improved technology

With DMFAS 7, debt offices will benefit from a new version of the DMFAS software that offers:

- Expanded debt data coverage

-

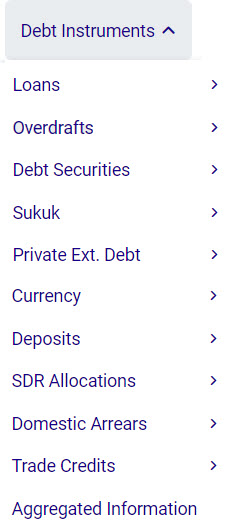

Coverage of instruments is being considerably enriched to include not only traditional debt instruments but also additional instruments to cover total public sector debt, including:

- Recording additional Instruments other than Loans and Debt Securities: Overdraft, Currency and Deposits, SDR Allocation, Trade Credits and Domestic Arrears.

- Identification of Collateralized Loans Instruments: percentage of collateralization and type

- Data collection from a wider range of institutions: Facilities such as electronic forms and import/export functions for sharing data from one entity to another (e.g., between local governments or SOEs and central government)

- Monitoring of contingent liabilities and of PPPs

- New calculations for instruments (including amortized cost in compliance with IPSAS standards)

- Extended Reorganization module handling all types of reorganizations and measuring the resulting impact and debt relief

- Recording and monitoring annual borrowing plan and auction calendars for external and domestic financing needs (Front Office functions)

- Monitoring status of debt instruments in contracting phase (Front Office functions)

- Redesigned Debt Securities module

-

- Fully redesigned business process workflow: improved recording of many instrument types such as indexed bonds

- Identification of Collateralized Debt securities: percentage of collateralization and type

- Improved classification reflecting international standards

- Caters for the recording of reopenings

- Additional calculation and valuation methods as per international standards, including Nominal Value and Market Value, calculation of accrued interest and amortized costs in compliance with IPSAS standards.

- New Cashflow functionality allowing to merge several series and generate an amortization table for multiple series.

- Facilitated linkages with the Auction module, enhancing valuation and optimizing re-openings and liability management operations.

- Improved data quality

-

DMFAS 7 includes tools and features to ensure the quality of the database:

- Instrument-based recording

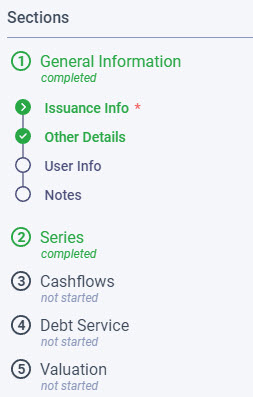

- Workflow indicating completeness

- Inline validation guiding users to complete required data and to easily detect errors

- Improved security and audit

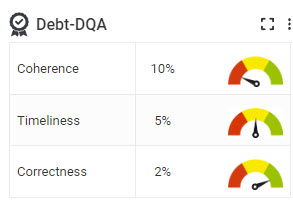

- Automated Debt-Data Quality Assessment (Debt-DQA) module

- Classification of debtors and creditors’ sectors as per latest international standards

- Additional calculation methods in compliance with new creditors’ types of loans

- Improved Reporting

-

Enhanced reporting and availability of information for analysis

DMFAS 7 integrates powerful reporting tools to generate a wide range of comprehensive standard and user-defined reports including:

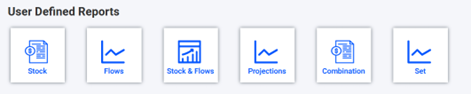

- Fully redesigned and user-friendly user-defined report module

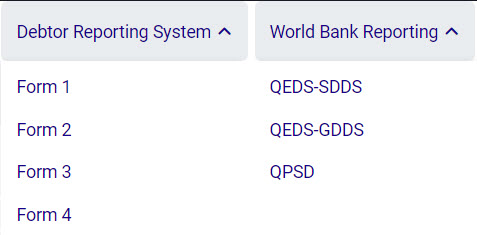

- World Bank Debtor Reporting System reports: Forms 3 and 4 added to the existing forms 1 and 2

- World Bank Quarterly External Debt Statistics and the Quarterly Public Sector Debt Statistics Tables

- Debt statistics tables and graphs and facilitated production of debt bulletins

- Expanded Analysis

-

Enhanced analysis offers new functionality including:

- Automated financial indicators calculation, debt ratios, interest and exchange rate scenarios, etc.

- Data export interface to the World Bank Medium-Term Debt Strategy and Debt Sustainability Framework tools

- Comprehensive debt portfolio analysis module covering debt composition, macro indicators and debt ratios, redemption profile and cost risk indicators

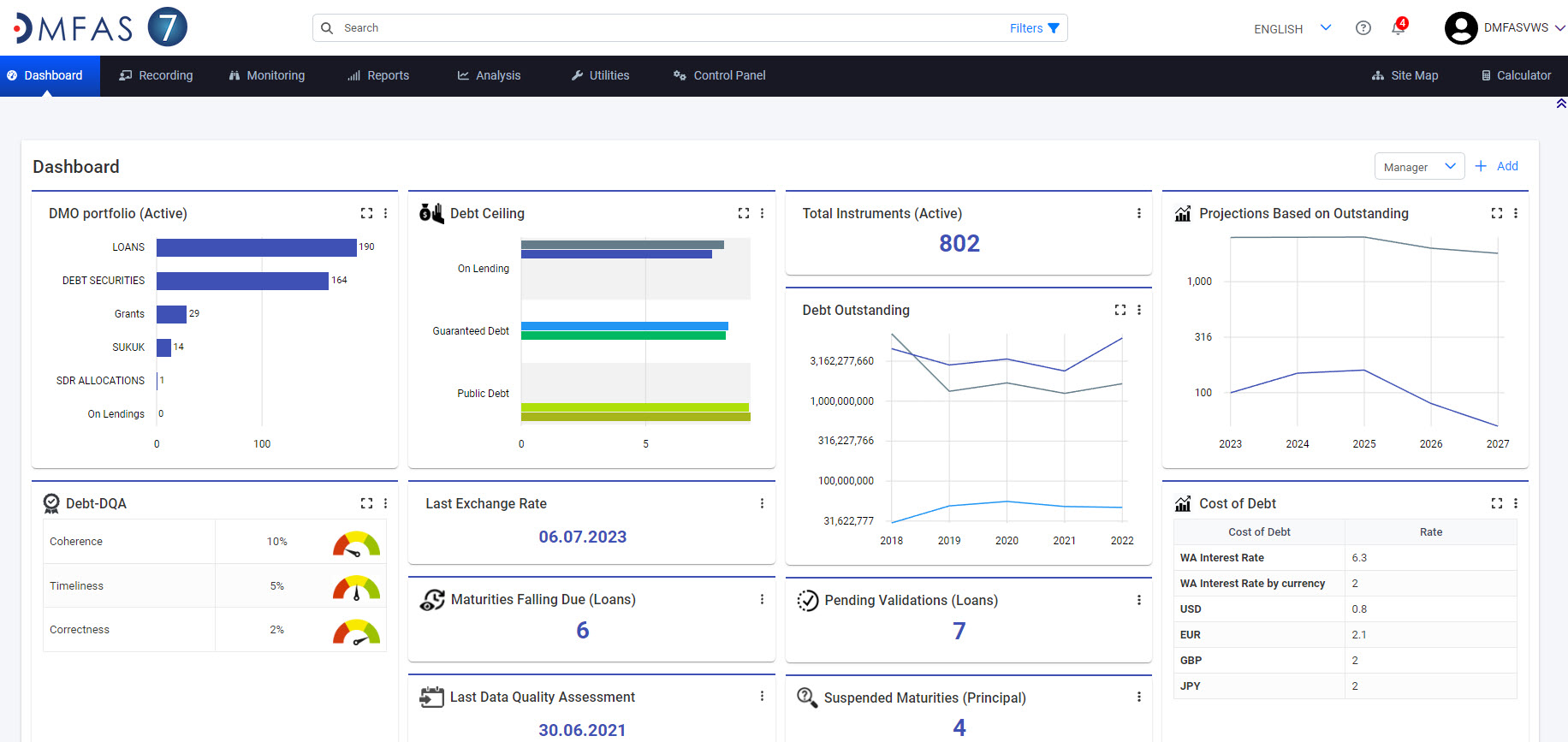

A new Management Dashboard offering different views based on user profiles

The DMFAS 7 Dashboard provides easy and customizable debt data visualization:

- 34 customizable widgets available, organized in 10 different categories including data composition, reminders, alerts, debt trend, debt indicators, Debt data quality assessment, etc..

- 3 different pre-defined profiles available: manager, analyst and operator

- Customization of data display: graphs, numbers, listing, colors, etc.

- Facilitated IFMIS integration

-

- Facilitated interfacing with other systems such as Integrated Financial Management Systems (IFMIS), Central Depository Systems (CDS), Reuters and Bloomberg.

- Technology

-

DMFAS 7 is being built using state-of-the-art, cutting-edge technology. It is developed with the latest Web Design and Application Standards, and implementing the latest Java features and standards:

- Updated frameworks and latest technology

- Full support for cloud computing, taking advantage of the Architecture as a Service Model

- Easy integration with other systems, using one single entry point for information sharing

- Enhanced security and auditing features

- Facilitated maintenance, due to Microservices Architecture

- Automated distribution of updates

- Multiple platform support (Unix/AIX/Solaris/Linux/Windows OS)

- Priority on Open Source, minimizing need for 3rd party licenses.

- Two servers minimum (Application Server and Database Server), in compliance with security standards

- Minimal workstation requirements, no restrictions on operating system (Microsoft, Open Source, Apple, etc), including mobile devices

DMFAS 7 will be distributed in two blocks:

DMFAS 7 Brochure: EN - FR - SP

DMFAS 7 Brochure: EN - FR - SP

DMFAS 7 hardware and software requirements

DMFAS 7 hardware and software requirements